This is a repost with permission from the author.

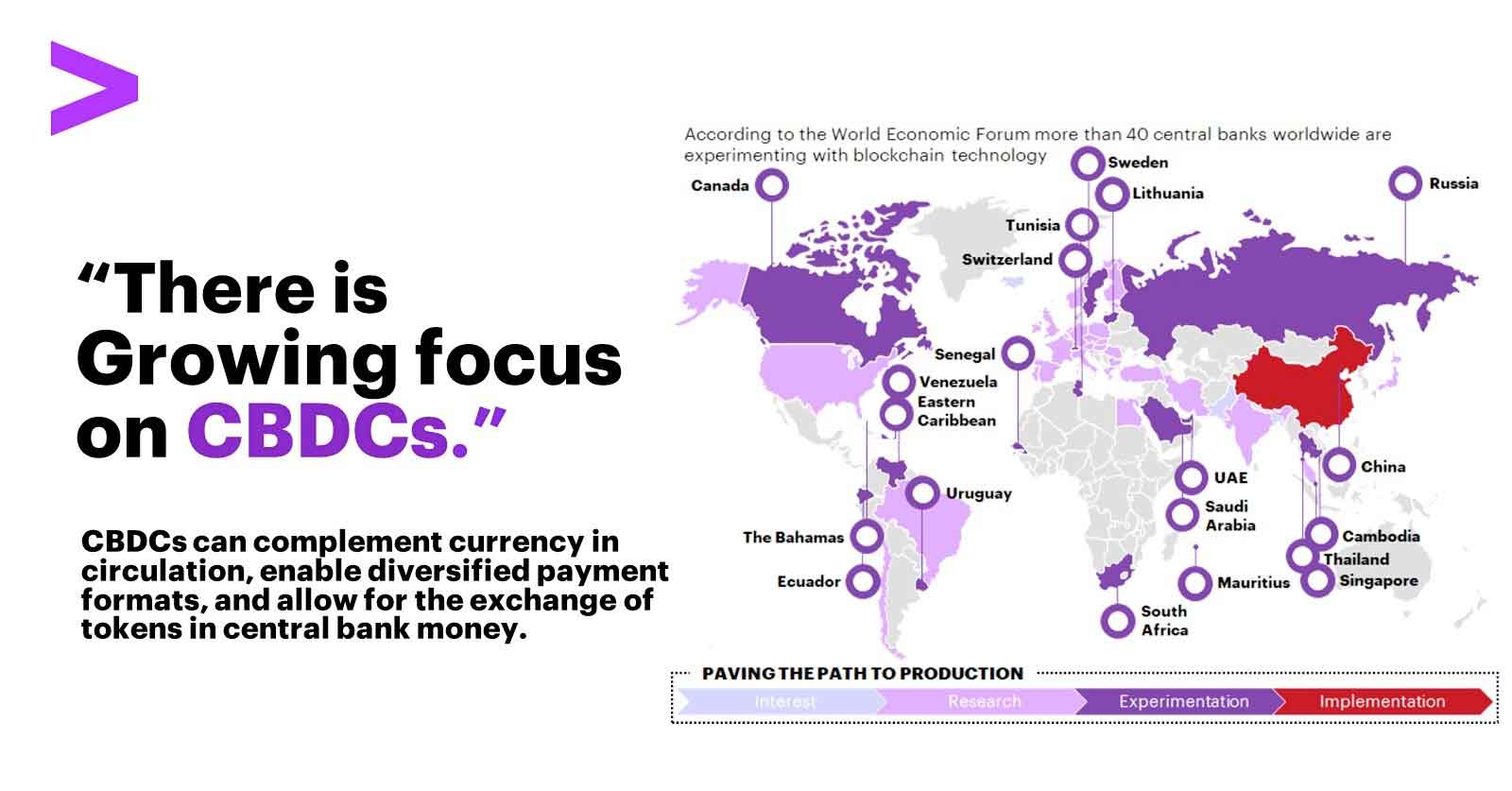

The Biden administration and the Federal Reserve are taking steps toward the potential roll-out of a central bank digital currency (CBDC). In attempting to do so, they are ignoring serious concerns about consumer privacy and heavy-handed government control in the U.S. and abroad.

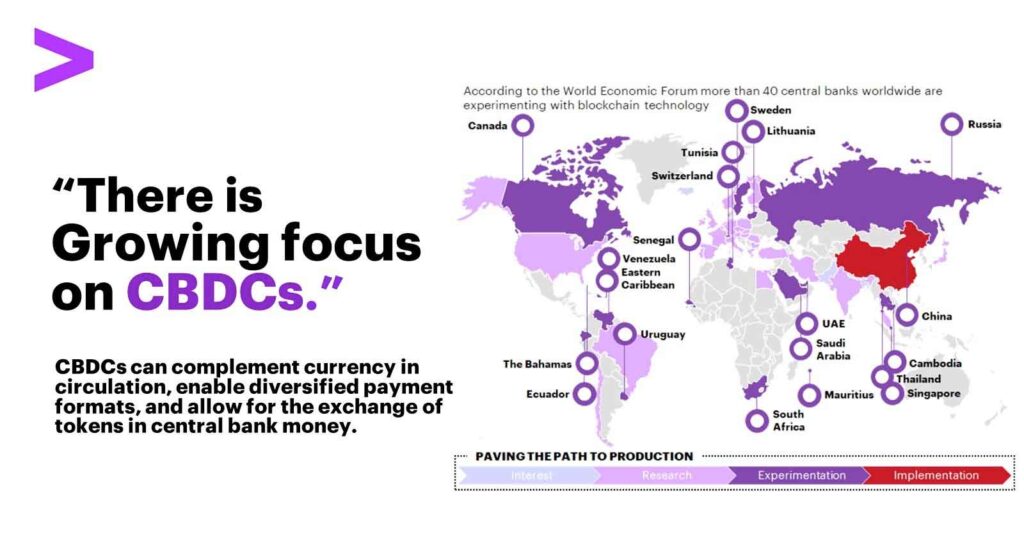

Everywhere around the world, powerful heads of central banks and politicians are pushing central bank digital currency. Yet also around the globe – from the U.S. to Europe to Africa – more and more of the general populace are rejecting CBDCs as they learn what they would entail and experience them in practice.

A CBDC is a digital form of a national currency issued or coordinated by a nation’s central bank. Unlike paper or a private decentralized digital currency, a CBDC leaves an electronic trail of purchases and sales within a government digital ledger. Ledgers of such information are in the hands of governments that in many cases have a dark history of abuses of civil liberties.

Proponents say CBDC would lead to faster payments that would particularly benefit lower-income individuals. Yet critics argue the mechanism for CBDCs is ripe for abuse, allowing the government to violate financial privacy and reward and punish certain behaviors by controlling access to digital money.

Measures of public reaction in the U.S. and elsewhere show that the general public – as well as a growing number of their representatives in their governments – are firmly on the side of critics of CBDCs. Americans are generally skeptical of grand new government initiatives. According to a recent Pew Research poll on faith in the American government, only 20 percent of the public currently trust the government.

Beyond general mistrust of government, Americans seem to specifically distrust the government wielding its powers with a CBDC. Most people don’t see a need for it, with just 16 percent supporting a Federal Reserve-controlled digital currency, according to a recent CATO Institute poll.

Europe is facing skepticism, as well. A growing number of members of the EU Parliament are saying they do not see any added benefit to a CBDC, Jack Schickler of CoinDesk reported in April. Markus Ferber, the economic spokesperson for the center-right European People’s Party, put it this way: “There’s one central question which hasn’t yet been credibly answered, which is what is the added value … what can I do with a digital euro that I can’t do with current payment options?”

Spanning the globe to Africa, an especially instructive lesson in the public’s reaction to the issuance of CBDC comes from that continent’s most populous country: Nigeria.

Nigeria rolled out its own CBDC, eNaira, in the fall of 2021 and invalidated all paper banknotes, making the economy one of the first entirely cashless systems in the world. Nigerians were less than thrilled, as mass protests, boycotts, and utter rejection of the CBDC have ensued.

Even though the Nigerian Central Bank released huge incentives for citizens to adopt eNaira, according to Kunwar Khuldune Shahid of the Daily Dot, only 1.5 percent of the downloaded wallets were used once a week in 2022. According to Nicholas Anthony from the CATO Institute, the Nigerian government “removed access restrictions so that bank accounts were no longer required to use the CBDC. Then… offered discounts if people used the CBDC to pay for [taxi]cabs.” No offer has swayed the population to this day.

Nigeria’s political climate may be somewhat different from that of the U.S. and Europe, but the reasons for rejection of a CBDC carry some important similarities. A CBDC in which the government holds the ledger of the purchases and sales made with the electronic currency – whether issued by the Nigerian Central Bank or the U.S. Federal Reserve — would grant the government total surveillance power over individual transactions. If Nigerians buy and sell anything using eNaira, the digital ledger will show the government their purchases. A CBDC in the U.S. would likely work the same way.

Given its poverty in comparison to the U.S. and Europe, the rejection of Nigeria’s citizens of a CBDC is a further blow to the dubious argument that issuance of CBDCs would somehow benefit the poor. Whatever benefits could be derived from the technology of the CBDC, Nigerians are concerned about their financial privacy and skeptical of government overseeing their purchases and sales. People worldwide agree that CBDCs greatly breach privacy regarding transactions between individuals.

In the U.S., lawmakers are introducing anti-CBDC legislation that should be a model for the world. In the U.S. House of Representatives, Rep. Alex Mooney (R-WV) introduced the Digital Dollar Prevention Act in June, which prevents the Federal Reserve from committing to any programs involving the development of a CBDC without the express approval of Congress. While House Majority Whip Tom Emmer (R-MN) earlier introduced a bill restricting Fed issuance of CBDCs, Mooney’s bill takes it further, expressly banning “pilot programs” that could create CBDCs indirectly through public regulatory states and the private sector (which is Nigeria’s current currency distribution and maintenance method).

More must be done overall to protect civil liberties and the stability of the American free market from the destructiveness of a CBDC. We need bipartisan efforts to protect financial privacy and oppose policies that go beyond the wishes of the governed. As we have seen from the experience of Nigeria and prescient observations of ordinary Americans and Europeans, a central bank issuing a digital currency by the U.S. is unwise and would further erode existing financial freedoms.